In its Judgment of 1 July 2014 in Ålands Vindkraft, C-573/12, EU:C:2014:2037, the Court of Justice of the EU (CJEU) departed from the previous Opinion of Advocate General Bot [EU:C:2014:37] and considered that the Swedish system of support of green energy is compatible with Article 34 TFEU despite the fact that it includes restrictions to trade in energy (and green electricity certificates) on the basis of nationality (rectius, on the basis of the place of production of that energy).

In its Judgment of 1 July 2014 in Ålands Vindkraft, C-573/12, EU:C:2014:2037, the Court of Justice of the EU (CJEU) departed from the previous Opinion of Advocate General Bot [EU:C:2014:37] and considered that the Swedish system of support of green energy is compatible with Article 34 TFEU despite the fact that it includes restrictions to trade in energy (and green electricity certificates) on the basis of nationality (rectius, on the basis of the place of production of that energy).

In my opinion, the case is important because: 1) the CJEU did not follow the more honest and transparent approach advocated for by AG Bot and has now perpetuated the doubts concerning the compatibility of environmental protection and internal market policies [particularly due to the conflation of Art 36 TFEU and 'Cassis de Dijon' mandatory requirements, as grounds for the exemption of restrictions to free movement], 2) it relies on economic assessments and the principle of legitimate investor expectations to a point that, in my view, exceeds the traditional balance or concern with pure economic aspects in the design of trade-restrictive policies (as well as only taking into consideration the economic burdens of some of the economic agents involved), and 3) the apparently pragmatic approach adopted by the CJEU actually restricts the potential ability of the EU as a whole to achieve its environmental protection commitments under the Kyoto Protocol. Each of these points deserves some further comments.

0. Background

0. Background

From the perspective of EU law on free movement of goods (art 34 TFEU), the Ålands Vindkraft Judgment is concerned with one of the classical 'conundrums' derived from every clash of policies and, more especifically, with the difficulties derived from the two-tier approach to the exemption of legislative measures that restrict trade in the pursuit of other goals.

The TFEU deals with those situations in a limited manner under Art 36 TFEU, which contains a restricted and exhaustive number of exceptions (numerus clausus) to the general prohibition of measures that restrict trade. The CJEU expanded the possibility to exempt other measures under the so-called 'mandatory requirements' theory as first established in Cassis de Dijon [Rewe-Zentral AG v Bundesmonopolverwaltung für Branntwein, 120/78, EU:C:1979:42].

The main difference between the Art 36 TFEU exemptions and those based on Cassis mandatory requirements was, according to the canon, that the former applied to both directly and indirectly discriminatory measures, whereas the latter could only exempt non-discriminatory (or equally applicable) measures. In the specific case of environmental protection, given its non-inclusion in the exhaustive list of Art 36 TFEU, the canon implied that it could only be used to exempt non-discriminatory measures. However, ever since the 2003 Judgment in EVN and Wienstrom [C-448/01, EU:C:2003:651], there has been intense debate as to whether environmental protection could be subsumed or conflated with one of Art 36 TFEU heads of exemption (ie 'the protection of health and life of humans, animals or plants') and, consequently, also be used to exempt directly discriminatory measures [for discussion, see E Engle, 'Environmental Protection as an Obstacle to Free Movement of Goods: Realist

Jurisprudence in Articles 28 and 30 of the E.C. Treaty' (2008) Journal of Law and Commerce 37: 113]. This was precisely the legal point to be addressed in Ålands Vindkraft.

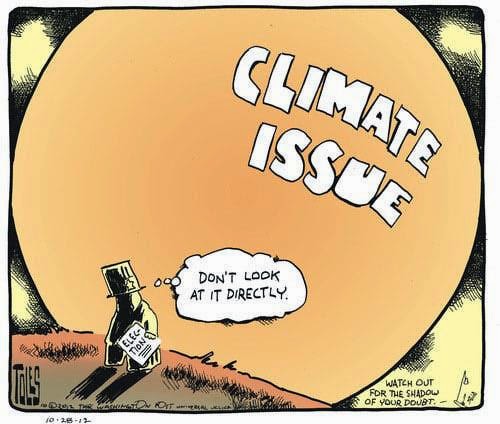

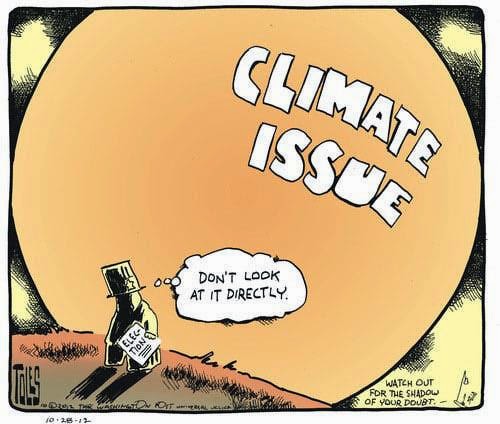

1. An obscure departure from the clear and honest approach advocated by AG Bot

1. An obscure departure from the clear and honest approach advocated by AG Bot

In his Opinion of 28 January 2014, and building on the more detailed proposal that he submitted in the Opinion in Essent Belgium [C-204/12 to C-208/12, EU:C:2013:294, not available in English] AG Bot took a bold step and suggested that "national legislation constituting a measure having equivalent effect to quantitative restrictions may be justified by the objective of environmental protection even if it is discriminatory, provided, however, that it undergoes a particularly rigorous proportionality test, one which I have referred to as ‘reinforced’" (para 79, emphasis added).

His proposal was basically aimed at overcoming the problematic conflation of environmental protection as a Cassis mandatory requirement and an (indirect) measure for the protection of health and life of humans, animals or plants. Moreover, the reinforced proportionality test (with all its problems), intended to reduce the margin of regulatory discretion that can be assigned to Member States under the Cassis doctrine.

However, the CJEU did not follow this bold, transparent and clear approach advocated for by AG Bot and, on the contrary and in an obscure manner, perpetuated the conflation in Ålands Vindkraft. Indeed, the CJEU considered that

77 According to settled case-law, national measures that are capable of hindering intra-Community trade may inter alia be justified by overriding requirements relating to protection of the environment (see, to that effect, Commission v Austria, EU:C:2008:717, paragraph 57 and the case-law cited).

78 In that regard, it should be noted that the use of renewable energy sources for the production of electricity, which legislation such as that at issue in the main proceedings seeks to promote, is useful for the protection of the environment inasmuch as it contributes to the reduction in greenhouse gas emissions, which are amongst the main causes of climate change that the European Union and its Member States have pledged to combat (see, to that effect, PreussenElektra, EU:C:2001:160, paragraph 73).

79 That being so, the increase in the use of renewable energy sources constitutes — as is explained, in particular, in recital 1 to Directive 2009/28 — one of the important components of the package of measures needed to reduce greenhouse gas emissions and to comply with the Kyoto Protocol to the United Nations Framework Convention on Climate Change, and with other Community and international greenhouse gas emission reduction commitments beyond the year 2012.

80 As the Court has pointed out, such an increase is also designed to protect the health and life of humans, animals and plants, which are among the public interest grounds listed in Article 36 TFEU (see, to that effect, PreussenElektra, EU:C:2001:160, paragraph 75). (C-573/12, paras 77 to 80, emphasis added).

From that point onwards, it is impossible to determine whether the CJEU bases its legal arguments in Art 36 TFEU as the protection of the health and life of humans, animals and plants is concerned or on the more general doctrine of mandatory or overriding requirements relating to the protection of the environment, or both. In my view, this is a lost opportunity for the clarification of this relevant point of EU law on free movement of goods. However, it may seem clear that (as Barnard justifies in The Substantive Law of the EU. The Four Freedoms, 4th edn, p. 172 and ff) the CJEU is not concerned with the legal basis used and that, currently, exemptions are fundamentally regulated under the principle of proportionality (but not necessarily under the 'reinforced' proportionality test advocated for by AG Bot). In itself, the perpetuation of this legal unclarity deserves some strong criticism. Not least, because of the flaws in the assessment of proportionality when it comes down to economic matters.

2. Unbalanced economic assessment and excessive reliance in (certain) legitimate expectations

2. Unbalanced economic assessment and excessive reliance in (certain) legitimate expectations

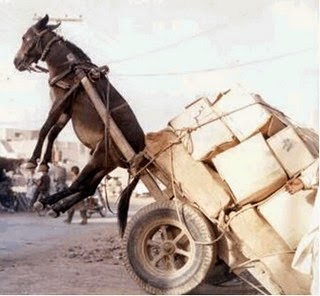

The economic assessment of the measures that the CJEU carries out jeopardises the soundness of the proportionality test that it carries out in paras. 83 to 119 of the Ålands Vindkraft Judgment.

On the one hand, the CJEU follows recital 25 to Directive 2009/28 and stresses that "it is essential, in order to ensure the proper functioning of the national support schemes, that Member States be able to ‘control the effect and costs of their national support schemes according to their different potentials’, while maintaining investor confidence" (para. 99). Even further, it indicates that "the effectiveness of such a scheme requires by definition a measure of continuity sufficient, in particular, to ensure the fulfilment of the legitimate expectations of investors who have committed themselves to such projects, and the continued operation of those installations" (para. 103). In that regard, the CJEU adopts an approach to the protection of the budgetary planning and constraints that Member States unavoidably face (particularly in terms of avoiding claims for compensation) that ressembles, but goes further than its approach in the restrictions to free movement of persons when the viability of the healthcare system is concerned. However, this approach fails to take into consideration that the incentives to investors are not unidirectional when it comes to environmental protection.

In the case at hand, energy producers based in Sweden may well have a clear need for an avoidance of changes in the regulatory regime on the basis of which they invested in the creation of renewal energy production facilities. However, those same investors may also have a very strong financial interest in being able to benefit from lower production prices or lower prives for green energy certificates in other Member States (eg, by acquiring cheaper green energy (certificates) in cheaper markets and selling theirs is highly-priced markets, if they identify opportunities for arbitrage). Moreover, some of those investors may wish to follow EU-wide or, at least, regional policies. That was the case of the appellant, Ålands Vindkraft when it was seeking to have green energy produced in Finland recognised under the Swedish scheme. Hence, by imposing absolute territorial protection to the schemes in support of green energy, Member States and the CJEU may actually be crowding out investors that do not wish to remain purely local. And that is not taken into consideration in the Ålands Vindkraft Judgment.

The reasoning in para. 118 also seems economically faulty to me. The CJEU considers that

provided that there is a market for green certificates which meets the conditions set out in paragraphs 113 and 114 above [ie proper functioning market mechanisms that are capable of enabling traders (...) to obtain certificates effectively and under fair terms] and on which traders who have imported electricity from other Member States are genuinely able to obtain certificates under fair terms, the fact that the national legislation at issue in the main proceedings does not prohibit producers of green electricity from selling (...) both the electricity and the certificates does not mean that the legislation goes beyond what is necessary to attain the objective of increasing the production of green electricity. The fact that such a possibility remains open appears to be an additional incentive for producers to increase their production of green electricity (emphasis added).

Effectively, what the CJEU affirms is that an importer that has already paid higher prices for green energy prices at origin (say, Finland) and that cannot use third country green certificates in Sweden, who then has to acquire (in fair terms, sic) additional green energy certificates in Sweden, has an increased incentive to produce green energy in Sweden. But that makes no sense unless this is complemented with the fact that such importer would have no incentive whatsoever to continue importing green energy into Sweden--hence reducing its production or demand for green energy elsewhere (say, Finland).

In my view, the proper considerations of these alternative (additional) economic effects may well have tilted the proportionality assessment in the other direction and forced the CJEU to conclude that the Swedish measure was not proportionate (as AG Bot proposed in his Opinion Ålands Vindkraft, para. 110).

3. A perpetuation of the difficulties that the EU faces to meet collective commitments under the Kyoto Protocol

3. A perpetuation of the difficulties that the EU faces to meet collective commitments under the Kyoto Protocol

As a final, functional point, it is worth stressing that the CJEU position in Ålands Vindkraft is squarely contrary to the fact that, as stressed by AG Bot in his Essent Belgium Opinion, the reduction of greenhouse gas emissions is just as effectively achieved through the use of foreign green electricity as domestic green electricity--which comes to undermine the global effectiveness of the EU's fight against climate change at the altar of the protection of domestic regulatory regimes and national budgets. The deference given by the CJEU to the political compromise achieved by the Member States in the passing of Directive 2009/28 (see paras. 53, 92, 94) can be actually self-defeating, given that the CJEU has completely given up on its role to push for a dynamic development of the internal market and for a clear support in the discharge of the EU's obligations vis-a-vis international partners. Indeed, it seems to me that the CJEU has sacrificed Art 194(1)(c) TFEU and, particularly, its "spirit of solidarity between Member States" in the altar of Member State finances. This may be a realist approach to the issue, but it definitely perpetuates the difficulties that the EU (as an international actor with separate legal personality) faces to act as one in the international arena and, particularly, to meet collective commitments under the Kyoto Protocol.

4. Conclusion

4. Conclusion

Overall, the Ålands Vindkraft Judgment deserves criticism from a strict legal perspective (due to the muddled situation in which it keeps environmental protection justifications to restrictions on free movement of goods), from an economic perspective (due to the partial and biased assessment of economic charges and incentives), and from a functional/political (international) perspective (as it diminishes the possibilities for the EU as a whole to comply with the Kyoto Protocol). Only Member States' Ministers of Finance can celebrate this situation...