Ofcom has unveiled its plans for 4G auction of the airwaves--which will be the largest ever auction of spectrum for mobile services in the UK--laying the path for next-generation 4G networks to be rolled out in 2013 and fully implemented by 2017 (see Ofcom's press release: http://tinyurl.com/Ofcom4Gauction).

The auction process seems well designed from the standpoint of a competition lawyer completely foreign to technical issues, particularly because Ofcom has reserved a lot for a relatively small player or new entrant in the UK mobile telephony market, so that consumers benefit from future competition between four credible service providers rather than the current three (see relevant documents for the planned 4G auction: http://tinyurl.com/Ofcom4Gauctdocs).

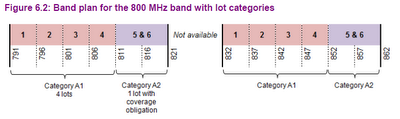

However, such a complicated regulatory scheme--whereby Ofcom is shaping future competition in the UK communications industry--must not only tackle the complex issue of the number of licenses tendered and the foreseeable sizes (and relative strengths) of tenderers, but also the matter of ensuring universal access (or a public service obligation) to the next mobile telephony networks. Ofcom has decided to do so by earmarking one of the lots (actually, a "double-sized lot", since there are four "regular" lots numbered 1 to 4 and the earmarked lot is "5 & 6") for the imposition of a coverage obligation.

In terms of the draft license for lot "5 & 6", the coverage obligation implies that the licensee shall by no later than 31 December 2017 provide, and thereafter maintain, an electronic communications network that is capable of providing, with 90% confidence, a mobile telecommunications service with a sustained downlink speed of not less than 2 megabits per second when that network is lightly loaded, to users at indoor locations in an area within which at least: a) 98% of the population of the United Kingdom lives, and b) 95% of the population of each of England, Wales, Scotland and Northern Ireland lives.

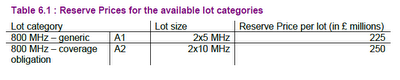

Given the undertaking of such coverage obligation by the awardee of lot "5 & 6", that licence is planned to be tendered at a significantly reduced reservation price of basically 55.56% of the reservation price for a "regular" licence (which has half the bandwith)--with an implicit "discount" of £200 million.

The relevant issue from the State aid perspective and, particularly, concerning compliance with Articles 106(2) and 107 TFEU is whether that difference in license reservation prices (rectius, of the prices finally paid by licensees as a result of the 4G auction) does not amount to an excessive compensation of the public service obligation (ie coverage obligation) attached to lot "5 & 6".

On the one hand, a formalistic approach to this issue could be simply accept that, in the absence of anomalies in the tendering process, the design of the 4G auction in open and competitive terms suffices to exclude any element of aid because the "pro-competitiveness" of the mechanism would warrant that the award reflects (competitive) market conditions (in an "inverse" reading of the fourth condition in the ECJ's Judgment in Altmark--on which see my critical considerations at http://ssrn.com/abstract=2071655).

On the other hand, a refined and materially-oriented approach would allow for the scrutiny of the difference in actual prices paid for a "regular" 4G license (double its price, actually) and the license with coverage obligation (lot "5 & 6")--to see whether it implied any potential excessive remuneration to the universal access provider. In that regard, it may be useful to take into account that Ofcom has commissioned and published a study on the "Methodologies used for the analysis of costs relating to a coverage obligation" (available at http://tinyurl.com/Ofcom4Gmethod). Nonetheless, this methodological study does not offer an aggregate total cost of the coverage obligation, which is dependent on the pre-existing infrastructure of the future licensee.

However, the study "Spectrum value of 800MHz, 1800MHz and 2.6GHz" by DotEcon and Aetha (also commissioned by Ofcom and available at http://tinyurl.com/Ofcom4Gmoneys) has estimated the impact of the coverage obligation in the (broad) bracket of between £100 to £400 million (although some operators submitted higher cost estimates). Even if the cost could be reduced by Ofcom if pre-auction mobile coverage was extended by means of additional public investments, and based on the information supplied by potential bidders in the auction, the DotEcon and Aetha study considers that:

There seems to be significant room (and difficulty) in determining the actual cost of the coverage obligation imposed upon the future licensee of lot "5 & 6" in the UK 4G auction. However, there is exacty the same room for potential overcompensation of such universal access / public service obligation--which would infringe Articles 106(2) and 107 TFEU.

Hence, special care seems to be needed on the part of Ofcom at the end of the auction and prior to the award of the licenses, whereby it may want to include a condition in the award procedure (or licence terms) that allows it to require additional payments by the initial awardee of lot "5 & 6" in case the price differential with (double) the cheapest (or more expensive, if a lenient approach is preferred, or average) "regular" 4G licence indicates that there is excessive compensation for the coverage obligation.

Be it as it may, it seems clear that there are potential State aid implications in the UK's 4G auction as designed by Ofcom, which will be an interesting case study once the final prices for "regular" and coverage obligation licenses are set.

A reasonable estimate of the cost of a 98% population coverage obligation should range from £100m to £400m as the cost estimate provided by Vodafone (and supported by O2) of £540m may not reflect the cost of meeting the coverage obligation by an operator with a well maintained, efficient network: John Cresswell of Arqiva estimated that the [98%] coverage obligation will cost around £200m to £230m, with Guy Laurence of Vodafone stating that a further £140 million in operating expenditure would be required to achieve 99% coverage (emphasis added; please note that £200 million is precisely the implicit discount in the reduced reservation price for lot "5 & 6").