© Martin Brandt / Flickr.

By Albert Sanchez-Graells (@How2CrackANut) and Michael Lewis (@OpsProf).*

The public sector’s reaction to digital technologies and the associated regulatory and governance challenges is difficult to map, but there are some general trends that seem worrisome. In this blog post, we reflect on the problematic compound effects of technology hype cycles and diminished public sector digital technology capability, paying particular attention to their impact on public procurement.

Digital technologies, smoke, and mirrors

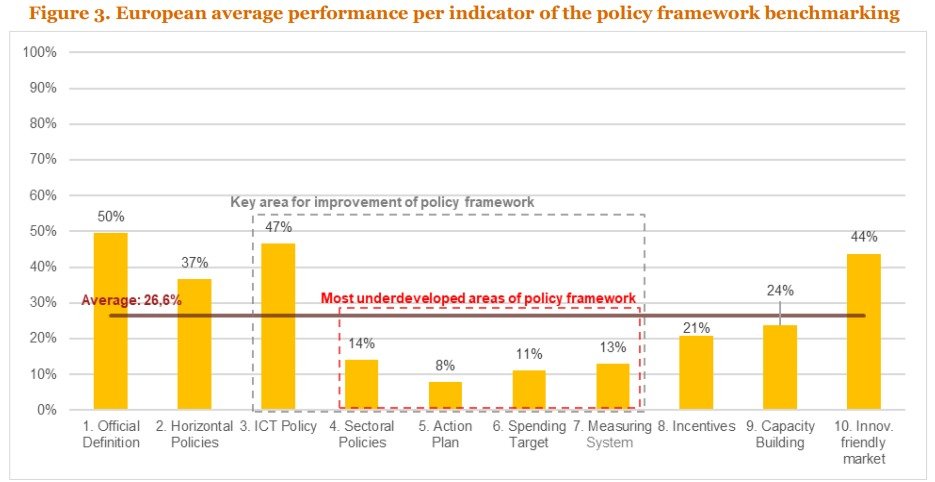

There is a generalised over-optimism about the potential of digital technologies, as well as their likely impact on economic growth and international competitiveness. There is also a rush to ‘look digitally advanced’ eg through the formulation of ‘AI strategies’ that are unlikely to generate significant practical impacts (more on that below). However, there seems to be a big (and growing?) gap between what countries report (or pretend) to be doing (eg in reports to the OECD AI observatory, or in relation to any other AI readiness ranking) and what they are practically doing. A relatively recent analysis showed that European countries (including the UK) underperform particularly in relation to strategic aspects that require detailed work (see graph). In other words, there are very few countries ready to move past signalling a willingness to jump onto the digital tech bandwagon.

Source: PWC, The strategic use of public procurement for innovation in the digital economy (2021: 9).

Some of that over-optimism stems from limited public sector capability to understand the technologies themselves (as well as their implications), which leads to naïve or captured approaches to policymaking (on capture, see the eye-watering account emerging from the #Uberfiles). Given the closer alignment (or political meddling?) of policymakers with eg research funding programmes, including but not limited to academic institutions, naïve or captured approaches impact other areas of ‘support’ for the development of digital technologies. This also trickles down to procurement, as the ‘purchasing’ of digital technologies with public money is seen as a (not very subtle) way of subsidising their development (nb. there are many proponents of that approach, such as Mazzucato, as discussed here). However, this can also generate further space for capture, as the same lack of capability that affects high(er) level policymaking also affects funding organisations and ‘street level’ procurement teams. This results in a situation where procurement best practices such as market engagement result in the ‘art of the possible’ being determined by private industry. There is rarely co-creation of solutions, but too often a capture of procurement expenditure by entrepreneurs.

Limited capability, difficult assessments, and dependency risk

Perhaps the universalist techno-utopian framing (cost savings and efficiency and economic growth and better health and new service offerings, etc.) means it is increasingly hard to distinguish the specific merits of different digitalisation options – and the commercial interests that actively hype them. It is also increasingly difficult to carry out effective impact assessments where the (overstressed) benefits are relatively narrow and short-termist, while the downsides of technological adoption are diffuse and likely to only emerge after a significant time lag. Ironically, this limited ability to diagnose ‘relative’ risks and rewards is further exacerbated by the diminishing technical capability of the state: a negative mirror to Amazon’s flywheel model for amplifying capability. Indeed, as stressed by Bharosa (2022): “The perceptions of benefits and risks can be blurred by the information asymmetry between the public agencies and GovTech providers. In the case of GovTech solutions using new technologies like AI, Blockchain and IoT, the principal-agent problem can surface”.

As Colington (2021) points out, despite the “innumerable papers in organisation and management studies” on digitalisation, there is much less understanding of how interests of the digital economy might “reconfigure” public sector capacity. In studying Denmark’s policy of public sector digitalisation – which had the explicit intent of stimulating nascent digital technology industries – she observes the loss of the very capabilities necessary “for welfare states to develop competences for adapting and learning”. In the UK, where it might be argued there have been attempts, such as the Government Digital Services (GDS) and NHS Digital, to cultivate some digital skills ‘in-house’, the enduring legacy has been more limited in the face of endless demands for ‘cost saving’. Kattel and Takala (2021) for example studied GDS and noted that, despite early successes, they faced the challenge of continual (re)legitimization and squeezed investment; especially given the persistent cross-subsidised ‘land grab’ of platforms, like Amazon and Google, that offer ‘lower cost and higher quality’ services to governments. The early evidence emerging from the pilot algorithmic transparency standard seems to confirm this trend of (over)reliance on external providers, including Big Tech providers such as Microsoft (see here).

This is reflective of Milward and Provan’s (2003) ‘hollow state’ metaphor, used to describe "the nature of the devolution of power and decentralization of services from central government to subnational government and, by extension, to third parties – nonprofit agencies and private firms – who increasingly manage programs in the name of the state.” Two decades after its formulation, the metaphor is all the more applicable, as the hollowing out of the State is arguably a few orders of magnitude larger due the techno-centricity of reforms in the race towards a new model of digital public governance. It seems as if the role of the State is currently understood as being limited to that of enabler (and funder) of public governance reforms, not solely implemented, but driven by third parties—and primarily highly concentrated digital tech giants; so that “some GovTech providers can become the next Big Tech providers that could further exploit the limited technical knowledge available at public agencies [and] this dependency risk can become even more significant once modern GovTech solutions replace older government components” (Bharosa, 2022). This is a worrying trend, as once dominance is established, the expected anticompetitive effects of any market can be further multiplied and propagated in a setting of low public sector capability that fuels risk aversion, where the adage “Nobody ever gets fired for buying IBM” has been around since the 70s with limited variation (as to the tech platform it is ‘safe to engage’).

Ultimately, the more the State takes a back seat, the more its ability to steer developments fades away. The rise of a GovTech industry seeking to support governments in their digital transformation generates “concerns that GovTech solutions are a Trojan horse, exploiting the lack of technical knowledge at public agencies and shifting decision-making power from public agencies to market parties, thereby undermining digital sovereignty and public values” (Bharosa, 2022). Therefore, continuing to simply allow experimentation in the GovTech market without a clear strategy on how to reign the industry in—and, relatedly, how to build the public sector capacity needed to do so as a precondition—is a strategy with (exponentially) increasing reversal costs and an unclear tipping point past which meaningful change may simply not be possible.

Public sector and hype cycle

Being more pragmatic, the widely cited, if impressionistic, “hype cycle model” developed by Gartner Inc. provides additional insights. The model presents a generalized expectations path that new technologies follow over time, which suggests that new industrial technologies progress through different stages up to a peak that is followed by disappointment and, later, a recovery of expectations.

Although intended to describe aggregate technology level dynamics, it can be useful to consider the hype cycle for public digital technologies. In the early phases of the curve, vendors and potential users are actively looking for ways to create value from new technology and will claim endless potential use cases. If these are subsequently piloted or demonstrated – even if ‘free’ – they are exciting and visible, and vendors are keen to share use cases, they contribute to creating hype. Limited public sector capacity can also underpin excitement for use cases that are so far removed from their likely practical implementation, or so heavily curated, that they do not provide an accurate representation of how the technology would operate at production phase in the generally messy settings of public sector activity and public sector delivery. In phases such as the peak of inflated expectations, only organisations with sufficient digital technology and commercial capabilities can see through sophisticated marketing and sales efforts to separate the hype from the true potential of immature technologies. The emperor is likely to be naked, but who’s to say?

Moreover, as mentioned above, international organisations one step (upwards) removed from the State create additional fuel for the hype through mapping exercises and rankings, which generate a vicious circle of “public sector FOMO” as entrepreneurial bureaucrats and politicians are unlikely to want to be listed bottom of the table and can thus be particularly receptive to hyped pitches. This can leverage incentives to support *almost any* sort of tech pilots and implementations just to be seen to do something ‘innovative’, or to rush through high-risk implementations seeking to ‘cash in’ on the political and other rents they can (be spun to) generate.

However, as emerging evidence shows (AI Watch, 2022), there is a big attrition rate between announced and piloted adoptions, and those that are ultimately embedded in the functioning of the public sector in a value-adding manner (ie those that reach the plateau of productivity stage in the cycle). Crucially, the AI literacy and skills in the staff involved in the use of the technology post-pilot are one of the critical challenges to the AI implementation phase in the EU public sector (AI Watch, 2021). Thus, early moves in the hype curve are unlikely to translate into sustainable and expectations-matching deployments in the absence of a significant boost of public sector digital technology capabilities. Without committed long-term investment in that capability, piloting and experimentation will rarely translate into anything but expensive pet projects (and lucrative contracts).

Locking the hype in: IP, data, and acquisitions markets

Relatedly, the lack of public sector capacity is a foundation for eg policy recommendations seeking to avoid the public buyer acquiring (and having to manage) IP rights over the digital technologies it funds through procurement of innovation (see eg the European Commission’s policy approach: “There is also a need to improve the conditions for companies to protect and use IP in public procurement with a view to stimulating innovation and boosting the economy. Member States should consider leaving IP ownership to the contractors where appropriate, unless there are overriding public interests at stake or incompatible open licensing strategies in place” at 10).

This is clear as mud (eg what does overriding public interest mean here?) but fails to establish an adequate balance between public funding and public access to the technology, as well as generating (unavoidable?) risks of lock-in and exacerbating issues of lack of capacity in the medium and long-term. Not only in terms of re-procuring the technology (see related discussion here), but also in terms of the broader impact this can have if the technology is propagated to the private sector as a result of or in relation to public sector adoption.

Linking this recommendation to the hype curve, such an approach to relying on proprietary tech with all rights reserved to the third-party developer means that first mover advantages secured by private firms at the early stages of the emergence of a new technology are likely to be very profitable in the long term. This creates further incentives for hype and for investment in being the first to capture decision-makers, which results in an overexposure of policymakers and politicians to tech entrepreneurs pushing hard for (too early) adoption of technologies.

The exact same dynamic emerges in relation to access to data held by public sector entities without which GovTech (and other types of) innovation cannot take place. The value of data is still to be properly understood, as are the mechanisms that can ensure that the public sector obtains and retains the value that data uses can generate. Schemes to eg obtain value options through shares in companies seeking to monetise patient data are not bullet-proof, as some NHS Trusts recently found out (see here, and here paywalled). Contractual regulation of data access, data ownership and data retention rights and obligations pose a significant challenge to institutions with limited digital technology capabilities and can compound IP-related lock-in problems.

A final further complication is that the market for acquisitions of GovTech and other digital technologies start-ups and scale-ups is very active and unpredictable. Even with standard levels of due diligence, public sector institutions that had carefully sought to foster a diverse innovation ecosystem and to avoid contracting (solely) with big players may end up in their hands anyway, once their selected provider leverages their public sector success to deliver an ‘exit strategy’ for their founders and other (venture capital) investors. Change of control clauses clearly have a role to play, but the outside alternatives for public sector institutions engulfed in this process of market consolidation can be limited and difficult to assess, and particularly challenging for organisations with limited digital technology and associated commercial capabilities.

Procurement at the sharp end

Going back to the ongoing difficulty (and unwillingness?) in regulating some digital technologies, there is a (dominant) general narrative that imposes a ‘balanced’ approach between ensuring adequate safeguards and not stifling innovation (with some countries clearly erring much more on the side of caution, such as the UK, than others, such as the EU with the proposed EU AI Act, although the scope of application of its regulatory requirements is narrower than it may seem). This increasingly means that the tall order task of imposing regulatory constraints on the digital technologies and the private sector companies that develop (and own them) is passed on to procurement teams, as the procurement function is seen as a useful regulatory mechanism (see eg Select Committee on Public Standards, Ada Lovelace Institute, Coglianese and Lampmann (2021), Ben Dor and Coglianese (2022), etc but also the approach favoured by the European Commission through the standard clauses for the procurement of AI).

However, this approach completely ignores issues of (lack of) readiness and capability that indicate that the procurement function is being set up to fail in this gatekeeping role (in the absence of massive investment in upskilling). Not only because it lacks the (technical) ability to figure out the relevant checks and balances, and because the levels of required due diligence far exceed standard practices in more mature markets and lower risk procurements, but also because the procurement function can be at the sharp end of the hype cycle and (pragmatically) unable to stop the implementation of technological deployments that are either wasteful or problematic from a governance perspective, as public buyers are rarely in a position of independent decision-making that could enable them to do so. Institutional dynamics can be difficult to navigate even with good insights into problematic decisions, and can be intractable in a context of low capability to understand potential problems and push back against naïve or captured decisions to procure specific technologies and/or from specific providers.

Final thoughts

So, as a generalisation, lack of public sector capability seems to be skewing high level policy and limiting the development of effective plans to roll it out, filtering through to incentive systems that will have major repercussions on what technologies are developed and procured, with risks of lock-in and centralisation of power (away from the public sector), as well as generating a false comfort in the ability of the public procurement function to provide an effective route to tech regulation. The answer to these problems is both evident, simple, and politically intractable in view of the permeating hype around new technologies: more investment in capacity building across the public sector.

This regulatory answer is further complicated by the difficulty in implementing it in an employment market where the public sector, its reward schemes and social esteem are dwarfed by the high salaries, flexible work conditions and allure of the (Big) Tech sector and the GovTech start-up scene. Some strategies aimed at alleviating the generalised lack of public sector capability, e.g. through a GovTech platform at the EU level, can generate further risks of reduction of (in-house) public sector capability at State (and regional, local) level as well as bottlenecks in the access of tech to the public sector that could magnify issues of market dominance, lock-in and over-reliance on GovTech providers (as discussed in Hoekstra et al, 2022).

Ultimately, it is imperative to build more digital technology capability in the public sector, and to recognise that there are no quick (or cheap) fixes to do so. Otherwise, much like with climate change, despite the existence of clear interventions that can mitigate the problem, the hollowing out of the State and the increasing overdependency on Big Tech providers will be a self-fulfilling prophecy for which governments will have no one to blame but themselves.

___________________________________

* We are grateful to Rob Knott (@Procure4Health) for comments on an earlier draft. Any remaining errors and all opinions are solely ours.