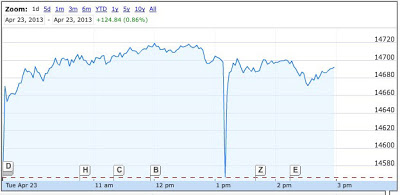

What happened yesterday with the US stocks should be more than a wake up call to what may be an unmanageable problem--which was anticipated some 4 years ago by @jonathanfields (and probably others, but which has not yet received serious attention).

The fact that anyone can attempt to manipulate stock prices by publishing false information on twitter definitely makes it a dangerous outlet. As useful as it is a tool to get real time information, it is also too good a platform to broadcast fake market intelligence. The fact that well-reputed twitter accounts can be hacked and used as a loud speaker for the fake news just complicates the scenario.

As a matter of principle, at least in the EU and the US, there are regulatory instruments in place to prohibit this manipulative type of conduct and to prevent the dissemination of false information with the purpose (or the foreseeable effect) of altering stock prices (hacking being dealt with by the criminal law of the relevant jurisdiction) [for general discussion, see R Söderström, Regulating Market Manipulation. An Approach to designing Regulatory Principles, Uppsala Faculty of Law Working Paper 2011:1].

In the US, the issue is dealt with in SEA section 9(a)(4) (with a requirement for the false information to be disclosed by a trading party (or a dealer or broker) that may limit its application to a case like yesterday's). In the EU, a 2003 Directive on insider dealing and market manipulation (reformed in 2008 and 2010) addresses this issue more broadly (and a proposal for stronger, criminal sanctions has been on the table since December 2012) and sets a mandate for EU Member States to prohibit any person from engaging in market manipulation (art 5), which under the relevant definition (art 2) includes

(c) dissemination of information through the media, including the Internet, or by any other means, which gives, or is likely to give, false or misleading signals as to financial instruments, including the dissemination of rumours and false or misleading news, where the person who made the dissemination knew, or ought to have known, that the information was false or misleading.

Notwithstanding the (theoretical) sufficiency of this regulatory framework (ie the law on the books, at least in the EU), it is just too obvious to point out that the enforcement problems are almost intractable when market manipulation takes place in social media--despite the recent efforts of financial authorities to provide updated guidance on these delicate issues (for instance, see the US SEC's guidance on the use of social media by issuers). Maybe it is time to set up a new task force (unless it is already in place, but I am not aware of it) to update the findings of IOSCO's 2000 Report on Investigating and Prosecuting Market Manipulation and adapt it to the very different social conditions that exist 13 years after its initial publication.