The Court of Justice of the European Union (CJEU) has published its 2016 Annual Report, including a detailed assessment of its judicial activity. Even at first read, it is clear that public procurement features more prominently in this year's edition, where the CJEU offers some comments on key ECJ cases, such as Falk Pharma, Partner Apelski Dariusz and Wrocław — Miasto na prawach powiatu, and PFE (see Judicial Activity Report, pp 64-65); as well as some comments on key GC cases on public procurement by the EU Institutions and on Commission's Decisions on Utilities Procurement, such as Österreichische Post v Commission, or European Dynamics Luxembourg and Others v EUIPO on the concept of conflict of interest (currently under appeal) (pp. 182-183).

The 2016 Annual Report also allows for an expansion of previous statistical analysis of the ECJ's and GC's case load in the area of public procurement (see also analyses for 2015, 2014 and 2012).

Interestingly, 2016 data shows a reduction in the accumulation of procurement-related backlog, which is now reduced to its 2010 level if the institution is taken as a whole. As the graphs below show, this reduction in backlog is mainly due to increased decision-making at ECJ level and to a significant reduction of new cases at GC level. It is worth taking a closer look at both issues.

Sharp reduction in number of new cases before the GC

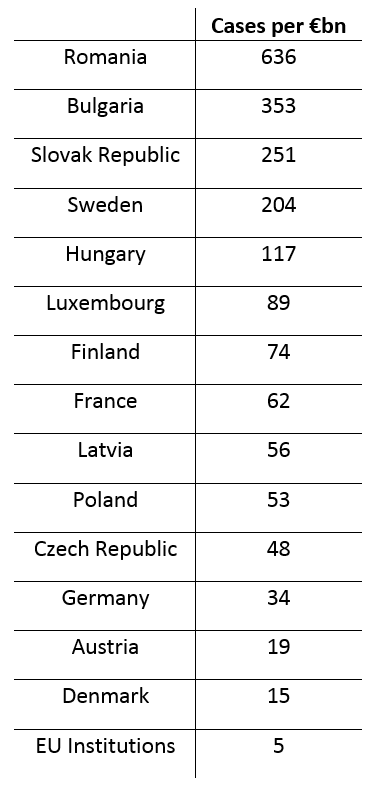

The number of new procurement cases before the GC dropped from 23 in 2015 to only 9 in 2016, which marks the all time lowest level since 2006, when the statistical series started. This sharp reduction in new cases allowed the GC to catch up with some of its backlog from previous periods and to reduce it by one third (from 35 to 24 pending cases in the 2015-2016 comparison). However, the low number of cases at GC level, which mostly concerns challenges to procurement decisions by the EU Institutions, continues to indicate that the creation of more effective remedies mechanisms applicable to EU institutional procurement remains a priority for regulatory reform (as stressed by the Court of Auditors).

Increased Decision-Making at ECJ Level

It is particularly remarkable that the ECJ managed to significantly increase its decision-making in the area of public procurement, moving from an average of 10 decided cases in the 2010-2015 period (with a highest output of 14 decisions in 2015) to 31 decisions in 2016. Coupled with a reduction in the number of new cases from 26 to 19 in the 2015-2016 comparison, this increased level of decision-making activity has cut the backlog of pending cases by one third, thus bringing it back to its 2014 level and stopping (at least for now) the worrying trend observed throughout this decade.

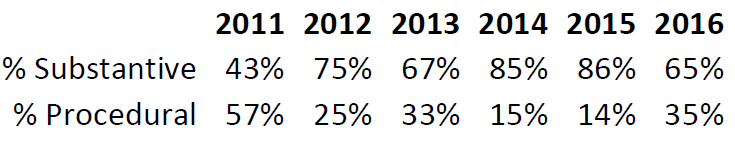

It is interesting to dig a bit deeper in the analysis of this remarkable surge in decision-making activity by the ECJ. The graph below shows the evolution of the public procurement decisions adopted by the ECJ, breaking down annual totals between those closed by Judgment or Opinion (ie substantive decision-making) and those closed by Order (ie procedural decision-making).

As the graph shows, the increased volume of decision-making has resulted in an increased total volume of both substantive and procedural decisions. The impact of this evolution on the different type of decisions may be easier to grasp through a simple ratio. As the table below shows, the increase in decision-making has in part been the result of the adoption of a larger proportion of procedure-based decisions. This may point towards the need for further case-by-case analysis in order to understand if this reflects any new trends concerning the ECJ's management of procurement cases, or if it is simply the result of the larger overall case load in this area. In any case, what is clear is that 2016 was a year of unprecedented substantive decision-making by the ECJ in the area of public procurement. No wonder it felt like such a busy year and that it was hard to keep up with all developments!