In his Opinion of 22 May 2014 in case C-201/13 Deckmyn and Vrijheidsfonds (once again, not available in English), AG Cruz Villalon has assessed the concept of 'parody' under Art 5(3)(k) of Directive 2001/29/CE on the harmonisation of certain aspects of copyright and related rights in the information society (Copyright Directive).

The Opinion is interesting because it concerns the degree to which fundamental rights' protection needs to be taken into consideration (as a matter of EU law) when making the relevant determination of the extension of the 'parodic' exception to copyright in a civil procedure.

This is one of the myriad of cases in which the Court of Justice of the EU (CJEU) will soon be concerned with the EU Charter of Fundamental Rights and, consequently, the proposals on the integration/coordination of these issues that the AG puts forward may be interesting beyond the scope of application of the Copyright Directive.

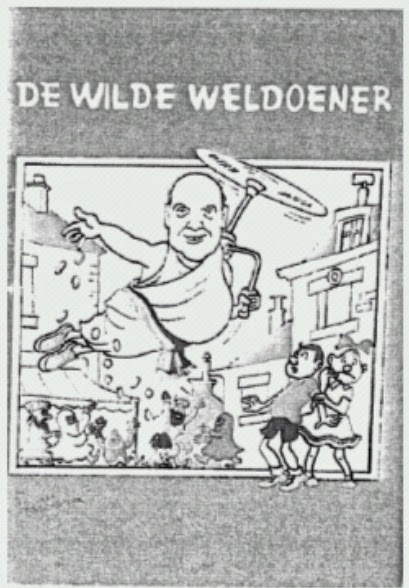

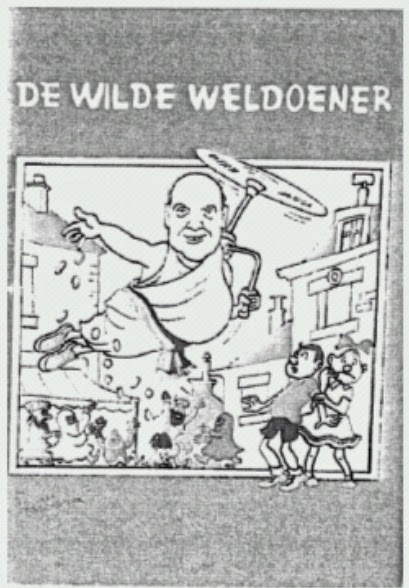

In the case at hand, a political party used a parody of a comic to criticise the then mayor of Ghent (Belgium). In the parodied copy, the name of the original author (Vandersteen) was included, with a reference that indicated that the current version was a "free adaptation" of the original work made by a second author (Fre) -- both designs are reproduced below, as they appear on AG Cruz Villalon's Opinion (original on the right).

The controversy basically derived from the fact that the parody had a discriminatory or racist content and, consequently, the heirs of the original author and the companies that currently hold the rights to the exploitation of his works tried to prevent such a use of Vandersteen's comic. The claim was technically framed as a challenge to the proper use of the materials as a parody, given that it was not the original work that was being parodied, but Ghent's mayor of the time. According to the claimants, that use would not be covered by the exception under Art 5(3)(k) of Directive 2001/29/CE.

AG Cruz Villalon, anticipating potential criticisms to his Opinion on the interpretation of the concept of parody, establishes important limitations to the scope of his arguments, where he makes clear that they do not include any elements regarding the moral rights of the author, the "three-step" test that Art 5(5) of the Copyright Directive establishes as a balancing requirement between the exceptions therein regulated and the protected rights, or the caveat that Belgian law introduced to the fact that parody is only acceptable provided it is conducted "in observance of good manners".

After confirming that, in his view, the concept of 'parody' (for the purposes of the Copyright Directive) is an autonomous concept of EU Law (paras 32-39), the AG goes on to consider that "Parody is [...] structurally, 'imitation' and, functionally, 'burlesque'" (or mocking, para 48, own translation from Spanish), and provides a significant amount of details as to his interpretation of both these structural (paras 49-58) and functional (paras 59-70) requirements. In my view, the most interesting part of his Opinion concerns paras 71-88, where he engages in a discussion on the incidence of the protection of fundamental rights on the (acceptable) content of the parody. The difficult question to be answered is, basically, "To what extent can the interpretation of the scope of the exception for parody given by the civil judge be determined by the protection of fundamental rights?" (para 76, own translation from Spanish).

The AG approaches the issue both as a matter of principle and introducing an exception. As a matter of principle, the AG submits that "always under the assumption that parody effectively meets the requirements already mentioned, an interpretation of the notion of parody by the civil court should, as a matter of principle, favor the exercise of freedom of expression through this unique medium" (para 81, own translation from Spanish). However, given that freedom of expression is never unlimited,

Considering the "presence" to be recognized to fundamental rights in the legal system as a whole, I understand that, in principle and from the narrow perspective of the concept of parody, a certain image cannot be excluded from this notion for the simple fact that the message is not shared by the author of the original work, or by the rejection that it may deserve from much of the public. Still, those deformations of the original work that, in the form or substance, convey a message radically contrary to the deepest convictions of society, and in which the European public space is ultimately built, and ultimately exists, should not be accepted as a parody, and the authors of the parodied work are entitled to enforce that restriction as well (para 85, own translation from Spanish, emphasis added).

Nonetheless, the final test proposed by the AG is rather mild and, in my view, is unnecessarily inconclusive, as he proposes the CJEU to find that "When interpreting the term 'parody', the civil court must be guided by the fundamental rights proclaimed in the Charter of Fundamental Rights of the European Union and proceed to the necessary balancing between those rights when the circumstances of the case at hand require".

I consider that the (self)restraint that AG Cruz Villalon shows in the final part of his Opinion in Deckmyn and Vrijheidsfonds is a clear indicator of the pusillanimous approach that we can expect the CJEU to adopt in cases like this one. Given that the concept of parody is a concept of EU law (for the purposed of the Copyright Directive, anyway) and that the CJEU holds the ultimate competence for the interpretation of the EU Charter [as coordinated with the European Convention on Human Rights and the case law of the European Court of Human Rights per art 52(3) EUCFR] the AG could have been more aggressive.

In my view, the AG should have clearly proposed that the CJEU interpreted that the concept of parody does not include 'those deformations of the original work that, in the form or substance, convey a message radically contrary to the deepest convictions of society' and, in particular, those that are racist, xenophobic or, in any other way, attempt against cultural, religious and linguistic diversity as protected in Article 22 of the EU Charter. Such a finding would still require the domestic courts of the Member States to determine whether, on the basis of the facts and circumstances of a given case, the intended parody is or not covered by the EU concept. However, the message would be much stronger and the CJEU would be effectively acting as a constitutional court for Europe, at least as the protection of the rights recognised in the EU Charter is concerned.

On the contrary, by deferring all judgment and providing no clear indication as to the way the balance is likely to tilt, the AG (and the CJEU if they follow the 'soft, self-restrained' approach in Deckmyn and Vrijheidsfonds) would once more be refusing to exercise their function as a constitutional court and, in my view, would indicate that all the fuss and complicated negotiations of the (prior involvement mechanism in order to authorise) accession of the EU to the European Convention of Human Rights would have been unnecessary and superficial, given their lack of commitment to a substantive and effective enforcement of the necessary protections of fundamental rights in the EU (for a critical assessment of the process and mechanisms involved in the accession, see the various contributions to Tzevelekos et al, The EU Accession to the ECHR).

From this perspective, I will be eagerly awaiting the CJEU's final ruling in Deckmyn and Vrijheidsfonds, although I must say that I do not hold high expectations and I would bet that they will follow the approach suggested by the AG (maybe including one or two 'strong' obiter dicta but) refusing to provide a clear indication of the way the balance of fundamental rights should tilt.

Let's hope the wait is over soon.

I just came back from my holidays and found my copy of V Kosta, N Skoutaris and V P Tzevelekos (eds), The EU Accession to the ECHR (Oxford: Hart Publishing, 2014). The book is the reworked compilation of some of the papers presented at a conference in Brussels in November 2012, plus other interesting contributions. I also contribute a chapter on corporate fair trial rights and competition law enforcement that was already available through SSRN. In the words of the editors:

I just came back from my holidays and found my copy of V Kosta, N Skoutaris and V P Tzevelekos (eds), The EU Accession to the ECHR (Oxford: Hart Publishing, 2014). The book is the reworked compilation of some of the papers presented at a conference in Brussels in November 2012, plus other interesting contributions. I also contribute a chapter on corporate fair trial rights and competition law enforcement that was already available through SSRN. In the words of the editors: